Online casino games represent just one among many entertainment choices available to players today, right at their fingertips. Brazil has emerged as the 5th largest gaming market globally, boasting more than 100 million players, and ranks as the 10th largest in terms of market value, estimated at USD 2.7 billion in 2021.

Top Games and Online Casino Trends in Brazil

As post-pandemic consumption habits take hold, a significant number of consumers are gravitating towards digital and mobile forms of entertainment that are readily accessible. The expanding middle class, coupled with a strong enthusiasm for gaming, highlights the vast potential of the industry while also indicating the presence of a discerning and demanding audience.

Source: KTO.com

What We Aim to Discover

According to a survey by Globo, by 2021, online casinos had reached a level of popularity in Brazil that was half that of state lotteries.

Our study, however, aims to delve deeper into this broad category of real-money online games to assess the online engagement of each gaming genre within the casino segment. Utilizing our own comprehensive big-data collections, we rank these games based on:

- Number of active players;

- Revenue generated within the casino section and average wager amounts;

- Number of game rounds played, including sessions, spins, etc.;

- Comparison between live casino versions and virtual games;

- Return to player (RTP) percentages.

Sports betting fans are relatively straightforward to characterize, with football undeniably being the crowd favorite. In contrast, online casinos have undergone less scrutiny in industry research, with roulette often emerging as a preferred choice, followed by blackjack and other classic table games.

The mindset of players globally is consistent—real-money games are seen as entertainment, a delightful hobby for most participants. Nevertheless, gaming trends are fluid, with new genres frequently emerging and influencing the gaming culture across different age groups.

Our focus extends beyond the general evolution of digital platforms. We aim to highlight the specific game categories and standout titles that captivate online casino players in Brazil.

An Overview of Best-Rated Casino Game Categories

External data sources, including Statista, confirm roulette’s top position in Brazil’s online casino scene, surpassing card genres, table games, and slots in popularity. Notably, despite lacking a physical counterpart like card games, slots are gaining traction due to their simplicity and fast-paced nature.

Live dealer games also warrant attention. These games, which include popular casino offerings, have become the preferred choice for half of the players, likely because they provide a more immersive and authentic experience, replicating the atmosphere of a casino floor.

However, these observations reflect consumption patterns that were prevalent before the pandemic. The younger generation, which generally has less disposable income, tends to gravitate towards more traditional casino games. Nonetheless, our latest rankings indicate a surge in popularity for new genres such as Crash-style games, which are capturing a wide audience across various demographics.

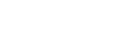

The table presents primary data from KTO, drawing on aggregated datasets from November 2022 through January 2023. Notably, the sum of the percentage of active players exceeds 100%, indicating that players are engaging with multiple game genres, providers, and titles.

Crash games lead in terms of active players in KTO’s casino section (nearly 80%), and they also account for the highest share of casino turnover (45.02%), with the second highest total number of game rounds. Slots, with their intrinsic design of free spins and bonus rounds, surpass all in game rounds (61.41%).

The rise of crash games aligns with previous industry analysis highlighting their growing popularity by late 2022. TV-style game shows, another emerging genre, rank fourth in aggregate rankings with 18.37% of active users on KTO. Despite their longer session durations, these game shows contribute only 2.93% to the total game rounds.

Roulette maintains a stable interest (27.87% of active players), but complex betting strategies lead to a lower number of game rounds (2.79%).

Other casino classics like poker, baccarat, and blackjack show a similar pattern, with monetary bets being twice as high as the proportionate number of active players, despite fewer total gaming sessions.

Source: KTO.com

Brief Historical Overview of Brazil’s Real-Money Gaming Scene

These gaming trends reflect both industry dynamics and the supply logic of the market, influenced by Brazil’s historic developments in real-money gaming. The Criminal Contravention Act of 1941 legalized only lotteries and horse race betting. A 1946 decree by President Dutra closed numerous casinos and labeled real-money gaming as a minor misdemeanor, leading to an era of underground gambling houses and illegal betting, with jogo do bicho as a prominent example.

The Zico Act of 1993 allowed bingo operations under specific conditions to support non-profit causes. Although the Senate blocked the Act, bingo halls continued until a 2004 bill against them. Eventually, the government passed Federal Law 13.756 in 2018, permitting sports and fixed-odds betting in principle but leaving the industry without specific regulations. This law reopened discussions about legalizing other forms of real-money games, with several bills currently proposed to regulate casino games, iGaming, and lotteries.

Most existing legislation does not encompass online games, as the advent of internet services was unforeseen. Consequently, online sportsbooks and casinos operate from abroad under foreign licenses and regulations, highlighting the complex and evolving landscape of Brazil’s real-money gaming scene.

Online Casino Games Fill the Market Void

Looking beyond the recent surge in popularity of crash games, it’s evident that other categories also mirror market demands that have been shaped over the past few decades. Despite the lack of a legal physical counterpart since the 1990s, slots continue to gain substantial online traction in Brazil, enjoying more popularity there than in other emerging markets like India.

The specific market demand in Brazil also accounts for the notable popularity of videobingo games, which attract 5.90% of active players. This preference highlights a cultural specificity, as videobingo does not enjoy the same level of popularity internationally.

The second most popular macro group of games includes “classic” casino games such as roulette and card games like poker, blackjack, and baccarat. These games demand a higher level of know-how and skill, particularly in betting strategies. Notably, poker is even formally recognized in some jurisdictions as a game of skill and considered a sport, underscoring its distinct status within the realm of casino games.

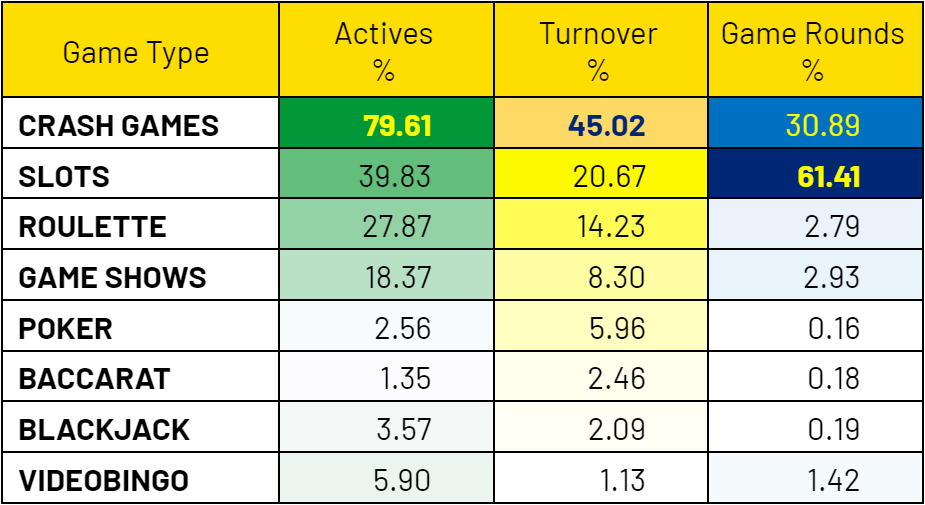

If we take a closer look at the specific titles that are most favored by casino players on KTO, the top 20 games can be characterized as follows:

- Crash Games – These games, which involve players betting on an increasing multiplier until it crashes, dominate the top positions due to their thrilling and fast-paced nature.

- Slot Games – A variety of themed slots feature prominently, appealing to players with their engaging graphics, immersive soundtracks, and bonus features.

- Roulette – Several variations of roulette make the list, attracting players with their blend of chance and strategy.

- Blackjack – Known for its strategic play, blackjack remains a staple, with multiple versions appearing in the top 20.

- Baccarat – This game, popular for its straightforward rules and quick gameplay, also ranks highly among the favorites.

- Poker – Various forms of poker, recognized for requiring skill as well as luck, continue to draw a significant number of enthusiasts.

- Videobingo – Particularly popular in Brazil, videobingo games are included due to their local cultural relevance.

- TV-style Game Shows – These games, which mimic the format of popular television game shows, offer an interactive and entertaining experience.

- Specialty Games – Unique and niche games that don’t fit the traditional casino mold also capture the interest of many players.

- Live Dealer Games – Offering a real casino experience from the comfort of one’s home, live dealer games are favored for their authenticity and interactive nature.

Crash Games dominate the casino scene, ahead or roulette and slots. Source: KTO.com

These rankings, based on the share of active players who have played at least one round, provide a nuanced view of current gaming preferences within the casino section. Notably, each game in the top 20 engages at least 5% of active players.

Crash games are currently leading the pack, representing a relatively new but rapidly dominant force in the real-money gaming scene. Their simplicity and lower technological demands contrast with the more tech-intensive game shows, which rely on advanced technologies like live streaming, visual effects, and augmented reality (AR) to enhance player experience.

Crazy Time stands out as a pivotal game in this landscape. It set the standard for crash games a few years ago by successfully integrating a crash-style algorithm with a live host and studio streaming, creating a bridge to game show audiences. However, the simpler crash games have since surpassed it in terms of player sessions and online visibility. This shift is not surprising, given their appeal to the preferences and habits of newer generations of gamers.

Like slots, crash games typically offer lower minimum wager requirements, making them accessible to a broad audience. Many players are already familiar with slots from local bars, as permitted during the Zico Act era, or from international exposure, such as trips or popular media depicting places like Las Vegas.

Both genres enhance player engagement through features like bonus rounds, quick spins, and autoplay. These features contribute to an increased number of game rounds, as shown in the initial data. Thus, it is evident that crash games have not only taken over the role previously held by slots but have also emerged as the leading product in Brazil’s online casinos and globally. This transition underscores a significant shift in the gaming landscape, highlighting the adaptability and evolving preferences of the gaming community.

Insights on Player Behavior

KTO’s platform showcases a vast array of over 2400 game titles, yet the top 20 alone account for 263% of the active player shares. This high percentage indicates that players frequently explore various games, often having multiple favorites across similar genres. Notably, even distinct categories like slots and crash games share common appealing features.

The game provider market is intensely competitive, prompting studios to distinguish their offerings through advanced visuals, thematic elements, and innovative reward systems. These enhancements often make the game mechanics less prominent for casual players, who are more drawn to the visual and interactive aspects of the games.

Understanding player preferences and behavior also involves examining how leading games fit into broader categories and share common features. Such analysis can provide deeper insights into what attracts and retains players.

Furthermore, the top 50 games on the platform contribute to 85% of the total casino turnover, highlighting games that have successfully cultivated a base of loyal fans, including both occasional and regular players. There are also vibrant gamer communities that form around specific real-money games, enhancing player engagement and loyalty.

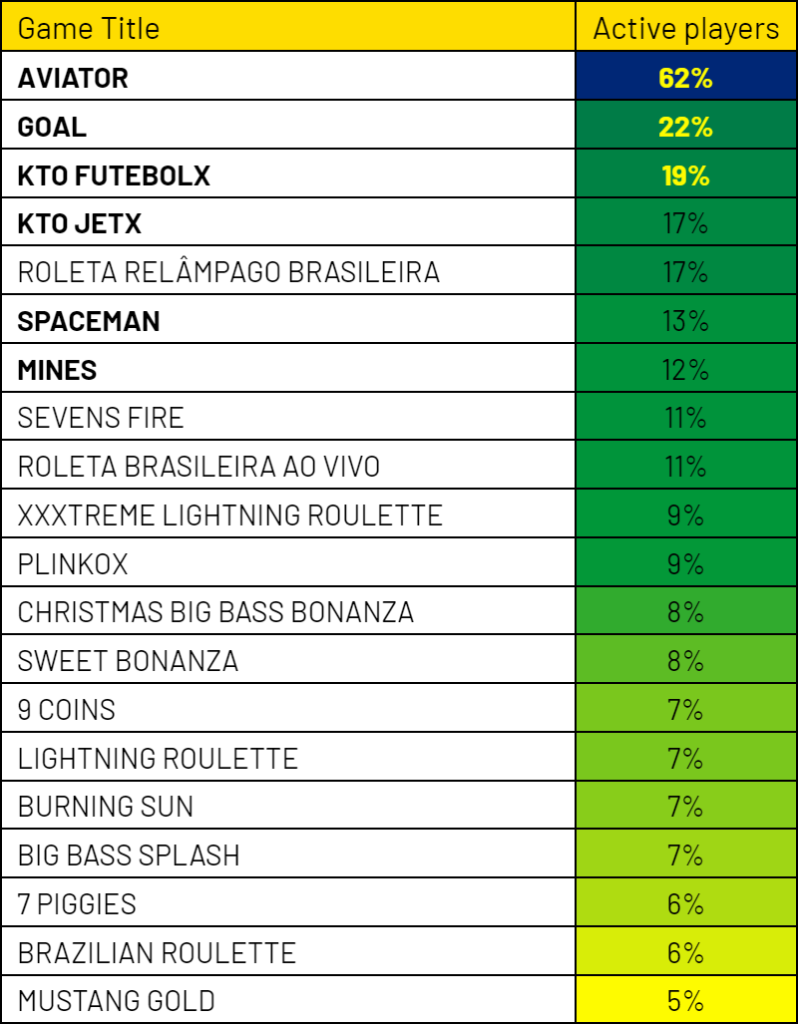

Among these, each game in the top 15 is significant, contributing at least 1% to the casino’s total turnover. This data not only underscores the popularity of these games but also their importance in driving the financial success of the platform. This information is crucial for understanding market dynamics and guiding future developments in game offerings.

Source: KTO.com

Once again, the prominence of crash-style games is evident, with titles like Aviator leading substantially by contributing a third of the casino’s turnover, followed by Goal with 5.28%. However, it’s clear that these games do not hold as significant an advantage in turnover as they do in active player percentages, as indicated in earlier data.

In the turnover rankings, roulette shows strong performance, with 7 tables ranking in the top 15. Notably, Casino Hold’em, a classic poker game, secures the third position, underscoring its popularity and the high stakes typically involved in poker games.

Online Casino Games with Highest Bet Averages

Both roulette and poker climb higher in the rankings due to their ability to generate more turnover per player and per round compared to other game types such as slots and crash games. This indicates that although they may not have as many active players, the financial contribution per game round is significantly higher, reflecting the higher betting stakes usually associated with these games.

The data on average bet amounts across different game families reveals that, with a platform-wide weighted average bet of EUR 1.15 (approximately BRL 6.43), slots and videobingo attract lower average bets. This is indicative of their accessibility and appeal to a broader audience that may not necessarily engage in high-stake gambling but prefers frequent, lower-value bets. This dynamic also highlights how different games appeal to distinct player segments, shaping the overall revenue and engagement patterns on the platform.

Source: KTO.com

Crash games slightly exceed the average bet size, whereas roulette tables attract bets that are up to five times the average per round, demonstrating their appeal to players who are willing to engage in higher stakes.

Poker, particularly games like Hold’em and Triple Card, attracts high rollers, maintaining solid betting averages even in the absence of VIP customers. With wagered amounts often exceeding 35 times the platform average, poker is affirmed as a predominantly skill-based game, appealing to those who are confident in their gaming abilities and prepared to place higher stakes.

Blackjack also showcases high average bets, with the first 35 tables on the platform recording some of the highest averages, closely followed by Baccarat, which is popular among high rollers and experienced players.

Live Games Preferred

A notable trend is the preference for live dealer games; 9 of the top 15 games are live dealer tables. Extending this observation to the top 50 games reveals that half are played live, underscoring the popularity of live gaming experiences.

These 25 live casino titles alone account for 29% of the total casino turnover, a significant contribution given the extensive game selection on KTO. This trend illustrates a clear preference for live versions of “classic” table games such as roulette and card games, as well as the increasingly popular game shows.

Live dealer versions are available in various languages, including Portuguese for Brazilian players, enhancing accessibility and player engagement. Notable games such as XXXTreme Lightning Roulette, First Person Blackjack, Casino Hold’em, and Super Sic Bo are examples where traditional casino floor games have been successfully adapted to live formats.

Game shows like Crazy Time, Monopoly Live, Football Studio, and Deal or No Deal have also thrived in live dealer formats, benefiting from consistently positive ratings and substantial online engagement.

Game providers strategically differentiate their offerings to cater to diverse market demands. Some studios focus on integrating advanced features such as augmented reality (AR), creating immersive experiences that emulate a real-world casino atmosphere. Others capitalize on simpler, faster, and provably fair games like crash-style titles and online slots, appealing to a broader audience looking for quick and engaging gaming experiences. This strategic diversity allows providers to meet various player preferences and maintain a dynamic and competitive edge in the online casino market.

Ranking of Top Games by Number of Rounds Played

The table presented below shows the distribution of rounds or sessions played, highlighting the top-performing games. These are initially organized according to their game providers.

Source: KTO.com

Market shares and current performance of game studios warrant a detailed analysis. Here’s a brief, user-friendly overview that explains their rankings in terms of game rounds.

Pragmatic Play, traditionally known for its slot games, has recently expanded into the crash games market with the release of Spaceman, which achieved immediate success. Additionally, they’ve broadened their offerings to include a Live Casino section featuring roulette, blackjack, and baccarat, along with game-show studios. This expansion illustrates their response to evolving market trends, despite their strong foundation in slots.

Spribe is emerging as a market leader with their innovative crash games and mini-games, which they refer to as Turbo Games. These are specifically designed to appeal to Generation Y, showcasing their specialization.

Both Gamomat and Wazdan continue to focus primarily on producing slot games.

The eight game providers displayed in the previous graph collectively account for 95% of the game rounds played and 96% of the casino turnover, albeit in a slightly different order. When ranking the top games by the number of rounds played, the following list emerges:

Source: KTO.com

Slots dominate the top 15 games, accounting for 61.41% of all game rounds played, making them the most prevalent category on KTO. New slot games are regularly introduced each week, keeping the lineup fresh.

Significantly, these slots are ranked after the market-leading crash game Aviator, and are interspersed with other popular crash games like Goal and Mines, which have shown consistent performance in recent months.

Among the slots, Sevens Fire is particularly notable, followed by Big Bass Splash, Sweet Bonanza, Mustang Gold, and Royal Seven XXL. Beyond the top ten, the variance in popularity is quite narrow.

These trends indicate a growing player preference for games that are quick and easy to play. A balanced blend of classic casino games and modern genres continues to draw in younger players while retaining the loyalty of older generations.

High RTP Is Crucial

A common feature of all top-rated games is their higher-than-average Return to Player (RTP). While Game Shows may deviate slightly from this norm, they compensate with their immersive live environments and engaging gameplay.

Most top performers boast RTPs over 90%, with several exceeding 94-95%. Crash games typically feature a “provably fair” RTP of 97%. Popular roulette tables and blackjack games, known for their low house edges, often offer RTPs above 97%, with blackjack sometimes reaching 98% or even 99% when using fewer decks, as is common in live dealer games. Baccarat tables generally maintain an RTP over 98%.

These games require a degree of skill or strategy, enhancing the players’ odds of winning. In contrast, slots provide a more straightforward and casual gaming experience, though this simplicity comes at the cost of reduced player decision-making.

Conclusive Summary of Findings

Brazilian players have consistently shown strong interest in online casino games, mirroring their global popularity. This trend is particularly notable given the absence of regulated land-based casinos in Brazil.

Our analysis indicates that certain game categories are more favored than others, with their rankings largely consistent across measures of active players, turnover, and game rounds.

Crash Games, despite their recent introduction to the online casino scene, have quickly become a favorite across various age groups. Slots, while second in most rankings, dominate when it comes to the number of game rounds played.

Online Roulette maintains its position as a casino staple, followed closely by card games such as blackjack, poker, and baccarat, which traditionally attract a significant number of players.

Game Shows represent a unique crossover genre that has carved out a stable market niche over recent years.

In betting behavior, most players prefer wagering small amounts frequently. There’s a general preference for games offering higher return odds, even if it means accepting greater volatility in potential winnings. Players tend to favor games with high Return to Player (RTP) rates, such as crash games, blackjack, roulette, and slots.

Our findings reveal two primary groups of games based on their gameplay characteristics:

- Quick-Play Games: This category includes mini and quick-play genres that appeal primarily to younger generations, offering a casual real-money gaming experience that’s easy and light. Yet, these games have broad appeal, attracting the most playtime, sessions, and users overall. Slots and crash games typify this category, with crash games emerging as a modern variant of slots.

- Immersive Games: Predominantly traditional casino-floor games, this group has undergone significant evolution in the past decade due to more accessible technology. These games feature enhanced visual elements and first-person engagement, making them more appealing. Live Dealer tables and immersive game environments are particularly popular here, where players invest fewer rounds or sessions but engage more deeply in terms of thought, strategy, and resources.

Overall, these insights reflect a dynamic online gaming landscape in Brazil, where both traditional and innovative game forms thrive, supported by technological advancements and changing player preferences.